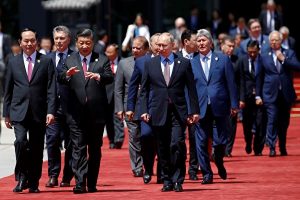

The Chinese Belt and Road Forum convened today in Beijing, China and will run till Saturday 27th April. There have been tensions around The Belt Road Initiative with some studies revealing that this initiative is packed with high risks for developing countries.

The Belt and Road Initiative (BRI), also known as the One Belt One Road (OBOR) or the Silk Road Economic Belt and the 21st-century Maritime Silk Road, is a development strategy adopted by the Chinese government involving infrastructure development and investments in 152 countries and international organizations in Europe, Asia, Middle East, Latin America and Africa. The initiative addresses an “infrastructure gap” and thus has potential to accelerate economic growth across the Asia Pacific area and Central and Eastern Europe. Under the umbrella of the Belt and Road, Beijing seeks to promote a more connected world brought together by a web of Chinese-funded physical and digital infrastructure.

Although the Belt Road Initiative aims at improving infrastructure and access, it has been met with a lot of criticism and question as to whether it is really the right move for the countries that sign up. Countries considering taking on Chinese investment — loans and financial obligations from China that are part of its BRI — should worry about specific risks, which range from financial sustainability to the erosion of national sovereignty. According to some, the infrastructure needs in Asia and beyond are significant, but the Belt and Road is more than just an economic initiative; it is a central tool for advancing China’s geopolitical ambitions. Some of the challenges presented by CNAS are erosion of national sovereignty, lack of transparency to the public, unsustainable financial burdens, disengagement from local needs, geopolitical risks and significant potential for corruption.

Some of the countries with the largest debt to China include; Angola- US $25Billion, Pakistan- US $16.3 Billion, Ethiopia- US $ 13.5Billion, Laos- US $11Billion and Kenya- US $7.9 Billion. Some countries are in danger of falling into the China debt/death trap. Last year, with more than $1 billion in debt to China, Sri Lanka handed over a port to companies owned by the Chinese government. Now Djibouti is about to cede control of another key port to a Beijing-linked company. The eight countries affected by Belt & Road debt are Djibouti, Tajikistan, Kyrgyzstan, Laos, Maldives, Mongolia, Pakistan and Montenegro. There were credible reports of talks between the Zambian government and China on handing over the country’s national electricity company, ZESCO to the Chinese due to the inability of Zambia to meet its loan repayment promises. This is expected as China is already in control of the country’s broadcasting company, ZNBC. There are also fears the main airport in Lusaka could be the next target. The worst part about the debts owed to China is that they will have to be borne by the next generation—the youth. For example, China owns more than 70% of Kenya’s bilateral debt which surpassed the US $50Billion mark. Each Kenyan citizen already has an estimated personal debt of US $ 1000 to China.

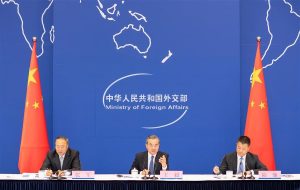

Critics argue that “China is smart and deliberate about its policy in Africa. It understands the development deficit on the continent and it is strategically using this to keep Africa’s economic future under its arms. Africa has what China needs to further propel its economy, specifically crude oil and copper. The best way to ensure an abundant supply of these in the future would be to make the depository countries owe it, which it has excellently done so far.” Although there may be good news for the countries with debts to China as President Xi announced that he as going to change some of the rules of the loans which would make it more sensitive to the countries in debt. But is this enough? Some researchers argue that “China should work to bring other countries into their investment programs to spread debt more equally and adopt stricter standards and more transparency about how sustainable its support for developing economies really is.”

What do you think?